Default Tax Rate for Specific VAT Treatments

Posted 8 years ago by Gidon

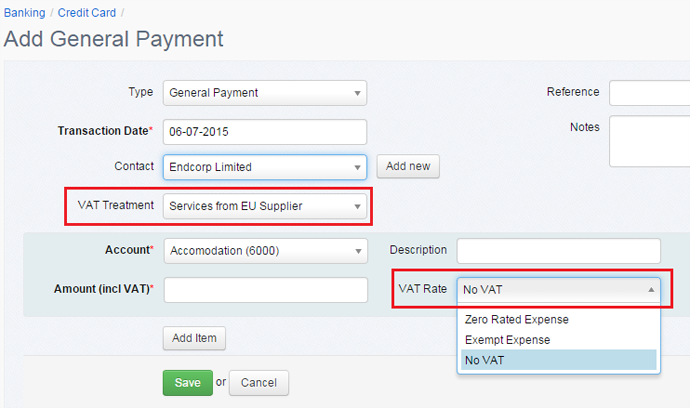

This change is only relevant to VAT registered organisations based in the United Kingdom and will be implemented on 11/07/2015. It impacts the use of the following VAT Treatments (all of which do not allow the use of Tax Rates greater than 0%):

· Sales of Goods to Customer outside EU

· Purchase of Goods from EU Supplier

· Purchase of Services from EU Supplier

· Purchase of Services from Supplier outside EU

Previously, there was no specific Tax Rate defaulting when one of these treatments was used in an Invoice or Bank Transaction. This resulted in Exempt Expense usually being selected as the next available option.

As of 11/07/2015, whenever one of these VAT Treatments is used, the default Tax Rate will be No VAT unless the default is taken from a Bank Import Rule or Product setting. The motivation for this change is that the use of No VAT results the more commonly required outcomes defined in the help document VAT UK – Box by Box.

Further Reading

Bank Feeds for your Online Accounting Software

AccountsPortal joins new Stripe Partner Program

Custom email settings allow you to change the From Name and Email Address