Online accounting software for your small business

AccountsPortal makes it easy to manage your invoicing, books and accounts. Try our no obligation 30-day free trial.

AccountsPortal makes it easy to manage your invoicing, books and accounts. Try our no obligation 30-day free trial.

AccountsPortal is used by thousands of contractors, freelancers, small businesses, bookkeepers and accountants to manage their books from anywhere.

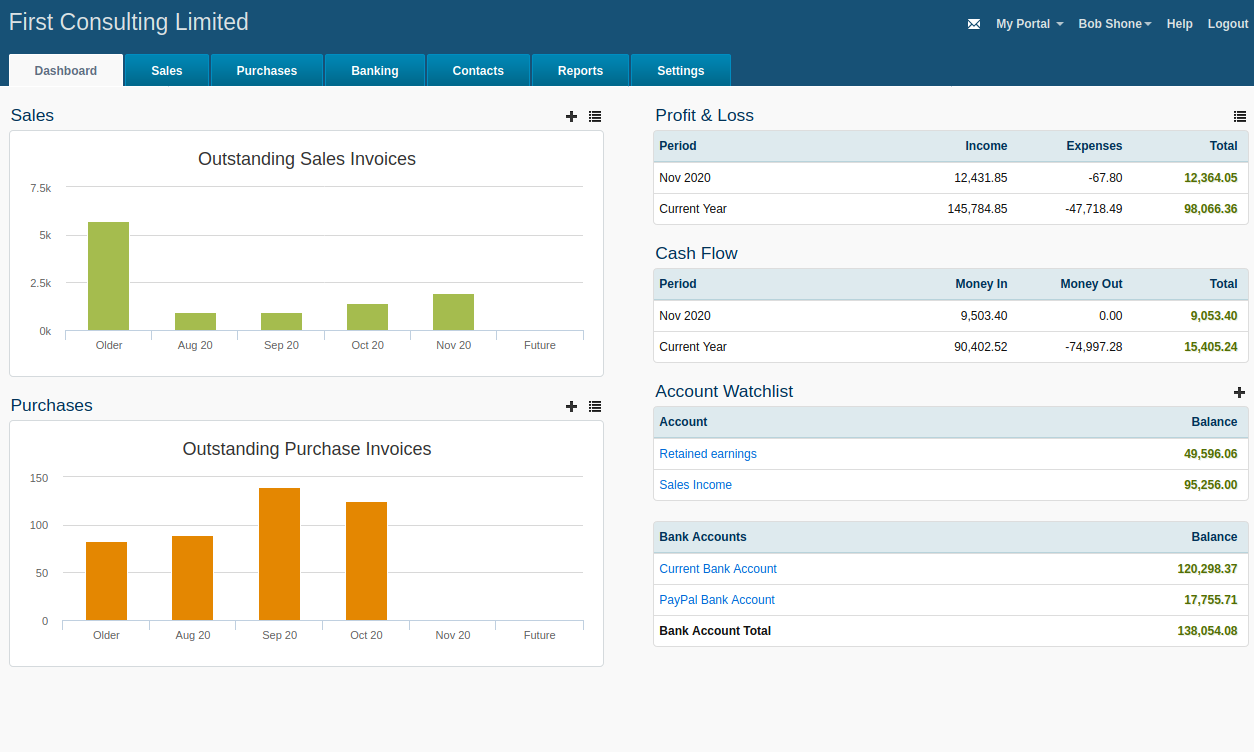

Our cloud accounting software is simple and easy to use - save hours each month, see your cashflow at a glance and get paid faster.

From April 2019 businesses that are VAT registered and above the VAT threshold (£85,000) must submit their returns digitally.

AccountsPortal has been working closely with HMRC, and we're proud to be listed as a recognised software supplier supporting Making Tax Digital for VAT.

This means that AccountsPortal is fully integrated with MTD, making it easy for businesses and accountants accounting software online to submit VAT returns directly to HMRC through our accounting software online.

Our easy online accounting software is intuitive and flexible. Get started in just a few minutes!

Amazing online help documentation and unlimited free access to our support team. We're here to help!

Create your own professional invoices and use recurring invoices to take regular payments.

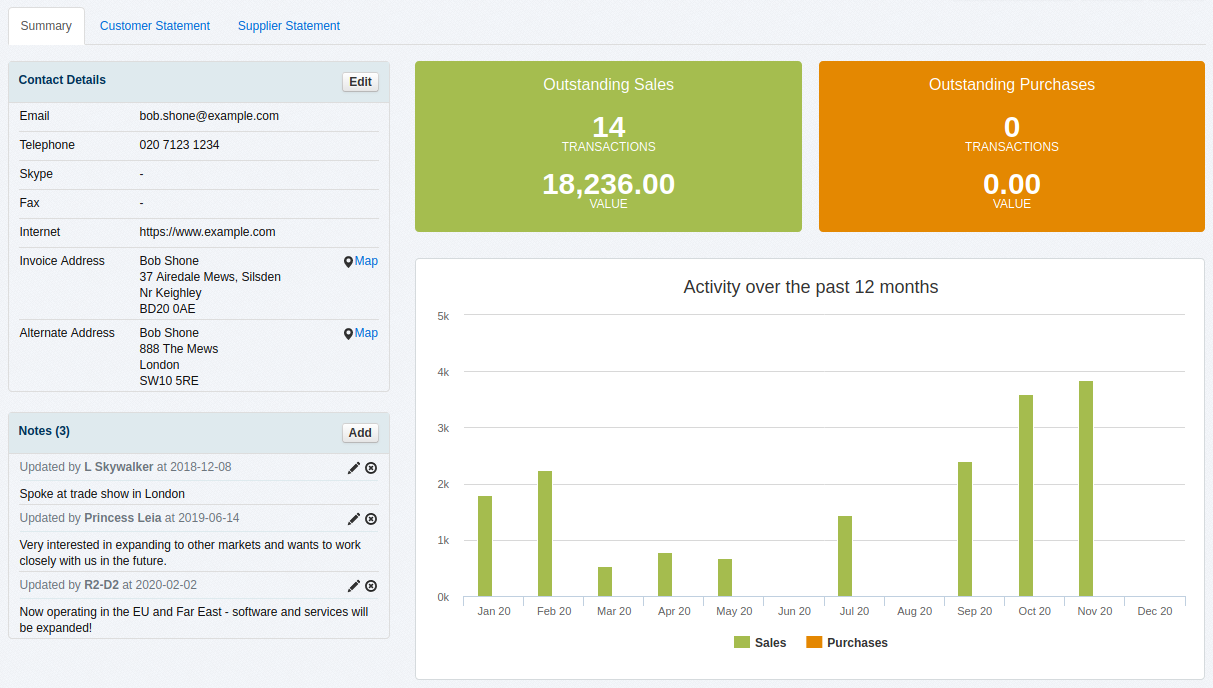

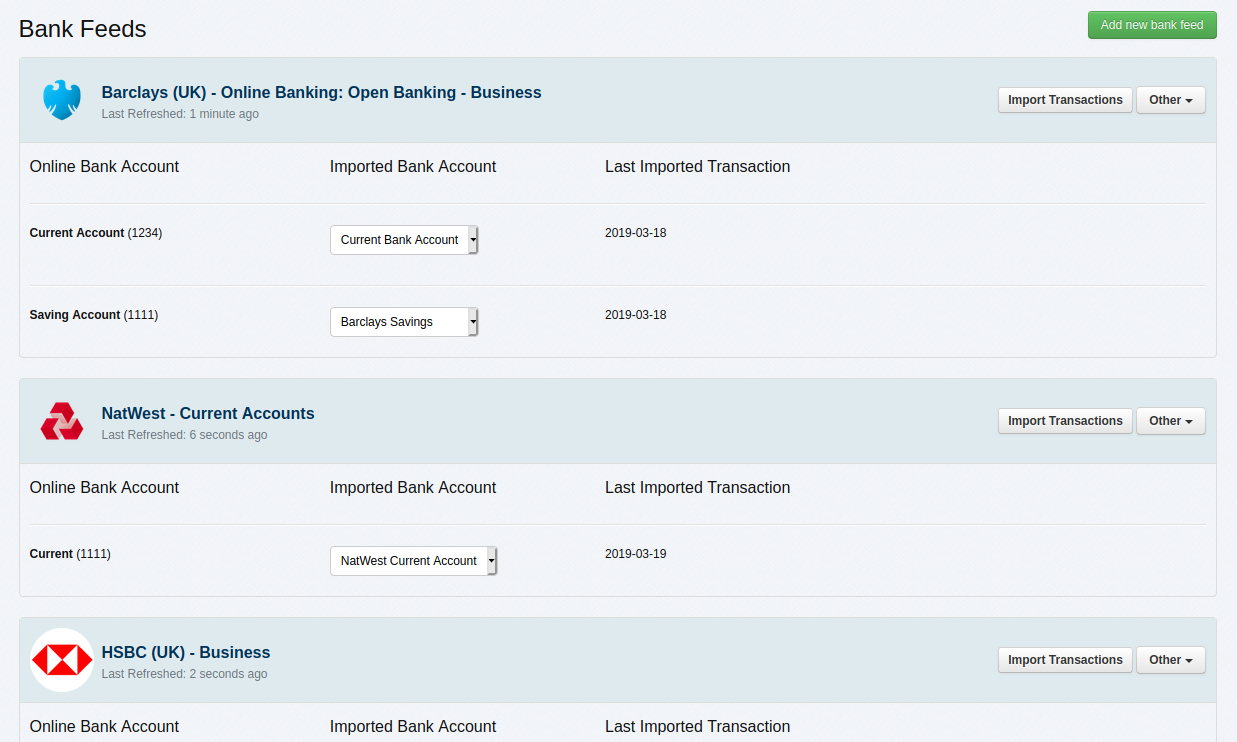

Easily keep up-to-date by accurately recording the money coming in and out of your bank account.

Speed up data entry, and track your performance across inventory, stock and service items.

Use categories to track and report across divisions, departments, people or any other classification.

Easily handle all VAT scenarios, including Standard, Flat Rate, EU Digital Services, VAT MOSS and more.

View your financial position anytime with our full range of easy to understand real-time reports.

Our best online accounting software is accredited by the ICB, the world's largest bookkeeping institute.

Thousands of small business owners use our online business accounting software to manage their books

I recommend AccountsPortal as the best cloud accounting software all the time, because its great value, easy to use and perfect for small businesses.

Your system is so intuitive and quick to learn. AccountsPortal is the best accounting software for small business and it's cost effective!

I appreciate the online element more than I expected. AccountsPortal is an accounts package at a reasonable cost, and a friendly interface.

I love the automatic emailing of invoices, quick and helpful customer service and easy recording of income/outgoing cash. AccountsPortal is the top online accounting software for a small company.

Cloud accounting software for small business with a 30 day free trial

Find out why our top accounting software offers the best value for money around.

Join the AccountsPortal Partner Programme and provide your clients with the best white label accounting software.

Designed with small business owners in mind, AccountsPortal gives you the tools to easily manage your small company finances.

If you need to generate professional invoices, reconcile your cash flow, or prepare a Making Tax Digital VAT return, our accounting software can help you.

Whether you’re just starting out or you’ve been in business for years, it’s important to have a solid grip on your finances. After all, if you don’t know if you’re making a profit, or have a healthy cash flow position, you’ll quickly find yourself in trouble.

We know that business owners have limited time, and you don’t want to spend hours on your books. That’s why we’ve put tools in place to support business owners crunch the numbers, while also adding in other features, including recurring invoices, automated bank feeds, personalised invoices, and more.

Absolutely! With unlimited user access, you can give access to your accountant, tax agent, or other advisers. What’s more, you can set specific permissions for each user, so you can be confident that all users will only have access to the data that they need.

AccountsPortal is also suitable for accountants and bookkeepers. Simultaneous login lets accountants review a business’ financial position in real-time with their clients, and advise on any adjustments that need to be made. It’s also easy for accountants to switch between different clients’ files at the click of a button.

We understand that choosing accounting software can be time consuming, and that it can be difficult to know which brand will suit you.

Our software has been designed to take away the stress of managing your company’s financials. We’ve designed AccountsPortal to be quick, easy and fast to use and you don’t need any prior accounting knowledge. The system is underpinned by a robust and powerful double-entry accounting engine, so the flexibility is available if you know your debits and credits.

In fact, we’re so confident in our product that we offer a 30-day free trial, so that users can see for themselves just how much easier life can be with good accounting software.

We use AccountsPortal as our online business accounting software - it is a simple, clean accounting system that has been of great benefit to our company.

It is very user friendly and the best features are accessibility, flexibility and value for money.