What is Making Tax Digital?

Making Tax Digital (MTD) is a key part of the government’s plans to make it easier for businesses to get their tax right first time and keep on top of their tax affairs.

To help make the UK’s tax system more efficient and effective, Making Tax Digital introduces digital record keeping requirements and requires the use of software that’s compatible with the Making Tax Digital platform.

This new digital experience is designed to help businesses minimise the number of avoidable errors they currently make, and make preparing and filing returns easier, and less stressful, for all parties involved.

Sign up for Making Tax Digital

The way you sign up for Making Tax Digital depends on whether you’re signing your business up yourself, or if your tax agent is signing up on your behalf.

Businesses signing up directly should be able to register using their Government Gateway login credentials, with further information available from HMRC here.

Agents should sign up their clients using their Agent Services Account, with detailed instructions available on HMRC's website.

Try AccountsPortal for Free

Get the Right Making Tax Digital VAT Software

Around 98% of VAT returns are already submitted digitally, but under Making Tax Digital there are new requirements that businesses and their accountants / bookkeepers should be aware of.

One of the most important new requirements is that VAT returns should be filed with HMRC using software that is compatible with the Making Tax Digital platform.

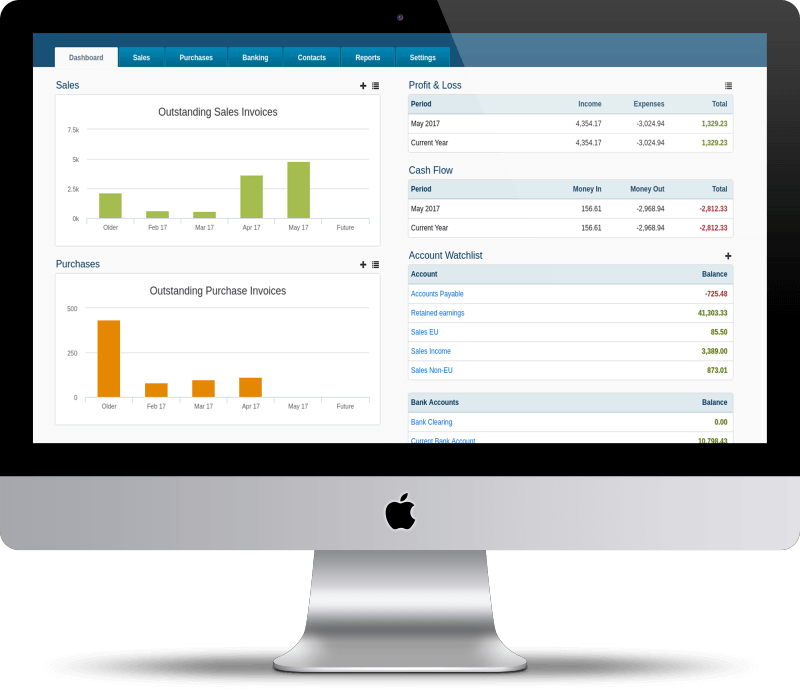

AccountsPortal has been recognised by HMRC as being Making Tax Digital compatible, meaning filing MTD compliant VAT returns is a breeze.

Digital Record Keeping

Our software ensures your business complies with the digital record keeping requirement of MTD, meaning there’s no need to use other software to record your VAT figures.

Online Filing

Seamlessly file accurate VAT returns online to HMRC using the data held in AccountsPortal.

VAT Information At Your Fingertips

Keep on top of your VAT compliance. Use AccountsPortal to view submitted VAT returns, check what VAT you owe to HMRC, and view your payment history.

Use AccountsPortal for your Making Tax Digital needs

Whether you’re a bookkeeper, accountant, or small business owner, AccountsPortal’s Making Tax Digital offering can help you get the most out of your VAT compliance.

AccountsPortal knows how important it is to keep on top of a client’s tax compliance. Our software allows you to interact with HMRC digitally and at a time that suits you.

It’s easy to get an increasingly personalised picture of your clients' tax affairs, with prompts, advice and support available through webchat and secure messaging.

By using digital software like AccountsPortal, information can be sent and received directly, with nudges and prompts built-in that help your clients get their tax right first time.

HMRC Making Tax Digital Software

Transitioning to Making Tax Digital for VAT doesn’t need to be a chore. Once you’re up and running, there are plenty of benefits to digital record keeping and online filing.

Efficiency

HMRC is helping accountants and small business owners save precious time by speeding up the VAT submission process and automating it as much as possible.

Better Use of Information

You should not have to give HMRC information that it already has or can obtain elsewhere. You will be able to use AccountsPortal to check the information that HMRC holds about your business at any time to ensure that it is complete and correct.

Reliability

This streamlined digital experience will integrate tax into day-to-day business record keeping, giving businesses confidence that they have got their VAT right, while having an accurate view of their tax position in-year.