Hospitality VAT Rate Cut - How To Manage The New 5% VAT Rate In AccountsPortal

Posted 5 years ago by Alison

Note that the Hospitality VAT rate has returned to it's original rate of 20%, please see our latest post on [how to manage the change within AccountsPortal](

https://www.accountsportal.com/blog/how-to-manage-the-final-hospitality-vat-rate-increase-in-accountsportal)

On the 8th of July 2020, Chancellor Rishi Sunak announced a reduction to VAT for the hospitality industry. All VAT on food, accommodation and attractions will be reduced to 5% for six months, with effect from Wednesday 16th July. The news has been welcomed by businesses in the industry, who have found themselves amongst the hardest-hit by the nationwide lockdown put in place in response to the COVID-19 pandemic.

The planned reduction is intended to encourage customers to return to restaurants, hotels and other attractions over the coming months as restrictions ease, bringing relief to any businesses adversely affected.

When it comes to managing these changes in your accounting software, AccountsPortal can already handle the VAT changes out of the box.

How to check that your accounting software is ready for the 5% VAT rate

In AccountsPortal, all UK-based companies are created with the required 5% VAT rates, which you can start using immediately.

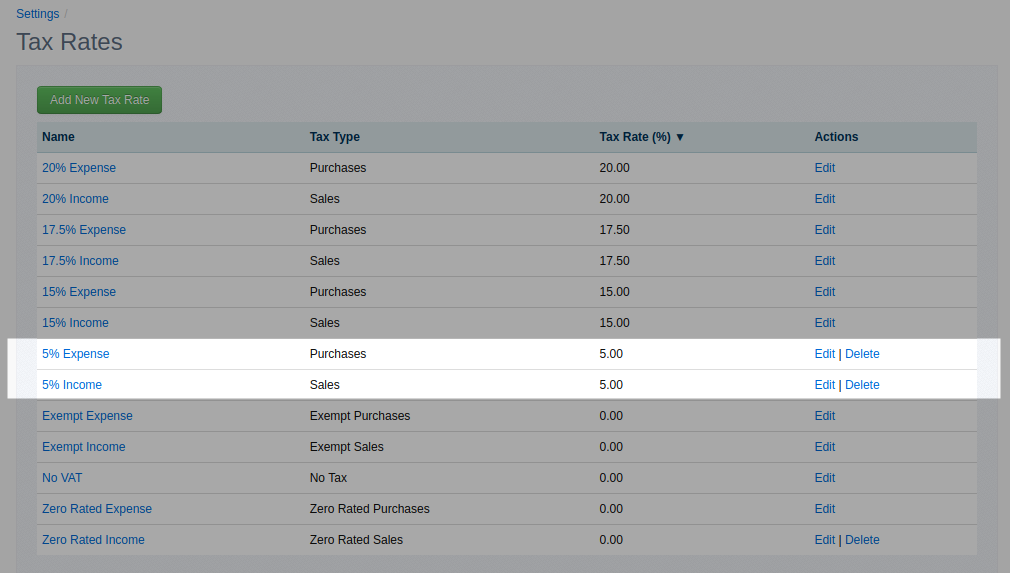

To check that you're ready, navigate to Settings, then click the Tax Rates link - you should see 5% Income rate (with a Tax Type of Sales) and a 5% Expense Rate with a Tax Type of (Purchases) listed in the Tax Rates table.

How to add new VAT rates

If either of the 5% tax rates are missing, you can add them as follows.

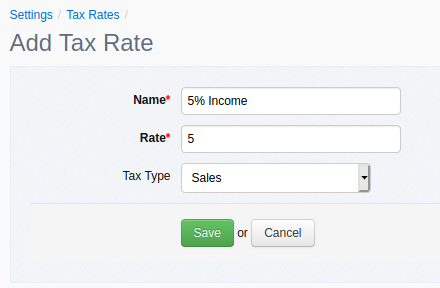

Sales Tax

For output (sales) tax, create a new rate of 5%, and specify "Sales" as the Tax Type

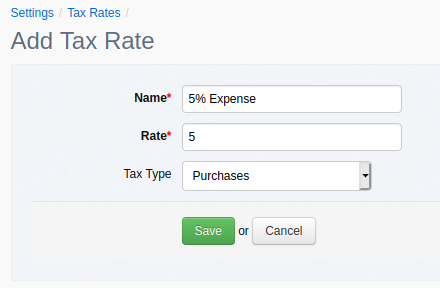

Purchases Tax

For input (purchases) tax, create a new rate of 5%, and specify "Purchases" as the Tax Type

Remember, you only need to add these rates if they don't already exist.

If you need any further assistance, please get in touch with us via our support pages.

Further Reading

A Guide to VAT on Property Transactions