How to manage the final hospitality VAT rate increase in AccountsPortal

Posted 3 years ago by Alison

The temporary VAT reduction for hospitality will finish on 31 March 2022, which will see it rise from 12.5% back to the original rate of 20%.

The new VAT rate applies to anything that falls into the industry of hospitality, hotel and holiday accommodation and certain transactions.

This can include:

- food and non-alcoholic beverages sold for on-premises consumption - for example, in restaurants, cafes and pubs

- hot takeaway food and hot takeaway non-alcoholic beverages

- sleeping accommodation in hotels or similar establishments, holiday accommodation, pitch fees for caravans and tents, and associated facilities

- admissions to the following attractions that are not already eligible for the cultural VAT exemption such as:

- Theatres

- Circuses

- Fairs

- amusement parks

- Concerts

- Museums

- Zoos

- Cinemas

- Exhibitions

- Similar cultural events and facilities Managing this change in AccountsPortal is quick and easy. All UK-based companies are created with the required 20% VAT rates, which you can start using immediately.

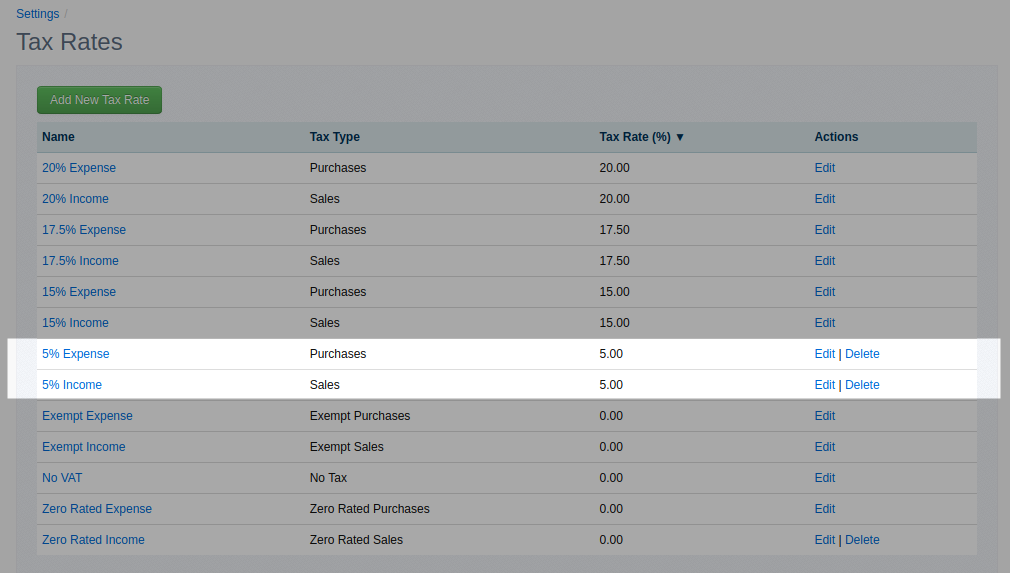

To check that you're ready, navigate to Settings, then click the Tax Rates link - you should see 20% Income rate (with a Tax Type of Sales) and a 20% Expense Rate with a Tax Type of (Purchases) listed in the Tax Rates table. How to add new VAT rates

If either of the new rates are missing, you can add them manually in just a couple of clicks. In the Tax Rates section, simply click Add New Tax Rate, specify the name and 20% rate and whether it's a sales or purchase tax. Save the changes, and you're done.

Further Reading

A Guide to VAT on Property Transactions