Blog Archive for 2018

Are You Ready to File Your Tax Return?

Tracy | 7 years ago

Although tax returns can seem intimidating, there are ways to prepare for an upcoming tax filing deadline without resorting to a last minute rush.

Here are a few simple steps to help you get ready.

How to Disagree with a Tax Decision by HMRC

Tracy | 7 years ago

This article outlines what you can do when you want to appeal a decision by HMRC in relation to a direct tax, such as corporation tax, income tax, and capital gains tax.

Budget 2018: Key Points for Small and Medium-Sized Businesses

Jon | 7 years ago

On Monday 29 October the Chancellor of the Exchequer delivered the Budget for 2018. In this article, explore how the Budget will impact on self employed and small businesses.

Finance Bill 2018-19 - Changes to Late Return Penalties

Gidon | 7 years ago

On 6 July 2018, the draft Finance Bill 2018-19 was released, part of which included measures relating to late submission penalties. These changes represent a significant shift away from the current penalty regime.

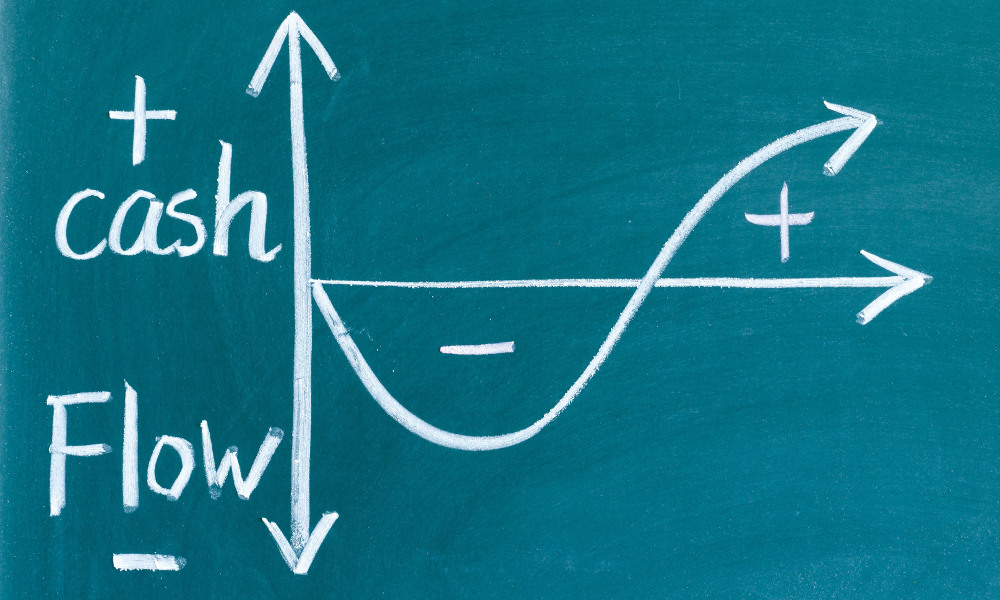

How to Prevent Issues Arising with Your Business' Cash Flow

Tracy | 7 years ago

Although your business may look to be profitable from an accounting perspective, profit is not the same thing as cash. This article explains some of the ways in which you can help boost your cashflow.

Could Your Business Claim More Tax Relief?

Tracy | 7 years ago

Often, small and medium-sized business owners fall into the trap of thinking that tax reliefs are only really available for huge multinational companies. Thankfully, this isn’t the case and there are plenty of tax reliefs available for SMEs as well.

AccountsPortal Recognised as a MTD Software Provider by HMRC

Jon | 7 years ago

Businesses that are VAT-registered with a taxable turnover over £85,000 will have to submit their VAT returns online to HMRC and will also be required to keep digital VAT records.

HMRC Outlines the UK’s VAT Landscape If No Brexit Deal Is Reached

Tracy | 7 years ago

HMRC recently released guidance outlining how the VAT system is expected to change in the UK in the event that no deal is reached during Brexit negotiations.

VAT Registration Threshold Consultation

Tracy | 7 years ago

In March 2018, the government released a call for evidence asking for input on whether changes could be made to the VAT threshold in order to incentivise growth for businesses.The call for evidence closed on 5 June 2018 and the government is currently reviewing the responses that it received.

The purpose of the call for evidence is summarised below, along with the measures proposed and how they could impact small businesses if adopted.

OTS Report Looks at Introducing PAYE to the Gig Economy

Jon | 7 years ago

In July 2018, the Office of Tax Simplification (OTS) published a paper, Platforms, the Platform economy and Tax Simplification. The paper examines ways in which the taxation system could be simplified for gig economy workers who work through an online platform, such as Uber or Deliveroo.

Although the paper contains a number of different proposals, one in particular has garnered attention – namely, the proposal to introduce an optional PAYE-style withholding system from certain workers who operate on online platforms.

The difference between a Bookkeeper and an Accountant

Tracy | 7 years ago

When you’re running a small business, it can be difficult to know who to turn to for help with your finances. As the terms "bookkeeper" and "accountant" are often used interchangeably by the general public, business owners can understandably become confused about which one they actually need.

Making Tax Digital for VAT – Will Calls For Its Delay Fall on Deaf Ears?

Jon | 7 years ago

There’s been a lot of talk about Making Tax Digital for VAT, and understandably so – coming into force from 1 April 2019, businesses that fall within the remit of the scheme only have a few more months to get their business ready.

AccountsPortal joins new Stripe Partner Program

Jon | 7 years ago

AccountsPortal is one of the first companies to join Stripe's new Partner Program.

Why You Should Switch to Online Accounting Software

Jon | 7 years ago

Over the past few years, the interest in and use of online cloud-based accounting software has increased dramatically. We outline below why switching to an online accounting software provider could be the right move for your business and how you should go about moving into the online arena.

IR35 Consultation on Private Sector Rollout

Jon | 7 years ago

IR35, also known as the intermediaries legislation, is an area of legislation that’s getting a lot of attention at the moment. Whether that’s down to decisions in appeal courts as to whether the IR35 legislation should apply to contractors, such as the cases of Christa Ackroyd and Mark Daniels, or because of changes to how the legislation is enforced in the public sector, there’s plenty of news to follow.

HMRC PAYE Forms For 2018

Jon | 7 years ago

There have been some updates to the PAYE forms on HMRC’s website, as well as some changes to the accompanying PAYE guidance. In this article, we outline what these main changes are and what they mean for you.

Tax-Free Allowances on Trading and Property Income

Jon | 7 years ago

The government introduced two new tax-free allowances for individuals on property and trading income in the Finance (No. 2) Bill 2017.

Although these two separate allowances were designed to help simplify the UK tax system, applying these allowances can be surprisingly complex in practice.

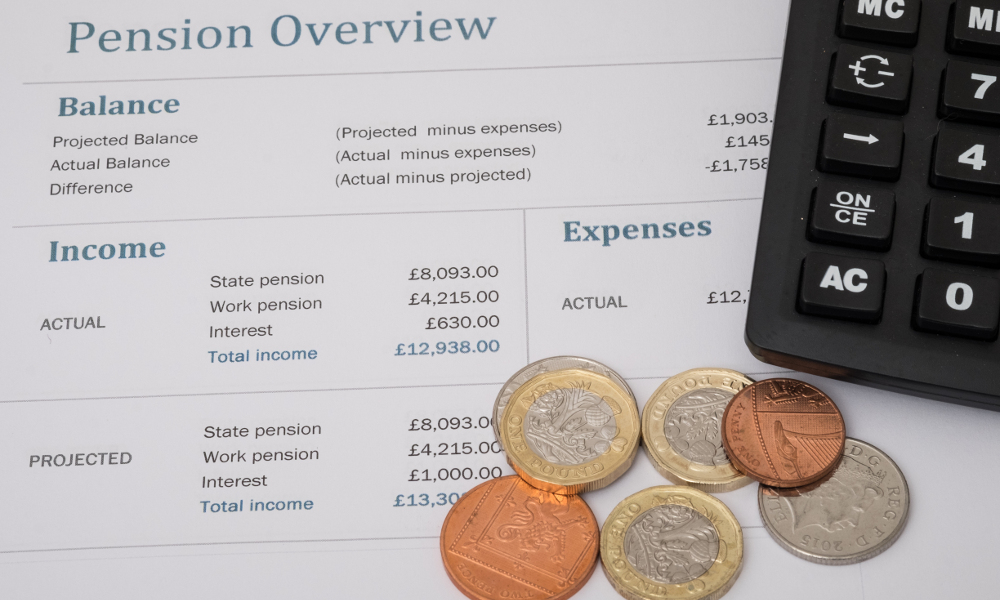

Increases to Minimum Pension Contributions: What You Need to Know

Jon | 7 years ago

There have been a number of changes to pensions over the years. Most recently, changes have been made to the minimum level of contributions required for automatic enrolment pensions. We outline what these changes are, who is likely to be impacted, and how your business can best prepare for the increases.

IR35 Presents Increasing Challenges for Contractors

Jon | 7 years ago

Navigating the IR35 legislation can be a minefield. In this guide, we highlight some of the difficulties that arise in applying the IR35 legislation. We also let you know what you can do if you think you fall under the provisions.

IR35 Explained — why it matters to independent contractors, freelancers and workers

Jon | 8 years ago

If you’re an independent contractor or freelancer, it's vital to understand the implications of IR35 so you can report and pay taxes properly and don’t suffer penalties from HMRC. In this guide we’ll break down what IR35 is, let you know if it might impact you, and what you can do as a result.