Blog Archive for 2020

How to White Label AccountsPortal

Gidon | 5 years ago

Accounting software is normally provided by a company under its branding and offering a specific set of features. But with AccountsPortal, you have the option to white label the software to give you more freedom to customise the offering to meet your needs.

How to account for an overpayment to supplier

Gidon | 5 years ago

An overpayment occurs when a payment for an invoice is larger than the invoice’s outstanding amount. Overpayments can arise on payments made to your business (e.g. a customer overpays one of your invoices) or on payments you make to a supplier or vendor.

In this article, we'll examine how to treat overpayments to suppliers.

What is Cash Accounting?

Tracy | 5 years ago

Cash accounting is an accounting method whereby payment receipts are recorded during the period in which they are received, and expenses are recorded in the period in which they are actually paid.

Covid-19 UK: A Guide to the Updated Furlough Scheme

Tracy | 5 years ago

As England enters another lockdown due to the Covid-19 pandemic, so the government's furlough scheme has once again been updated to provide economic support to those unable to work.

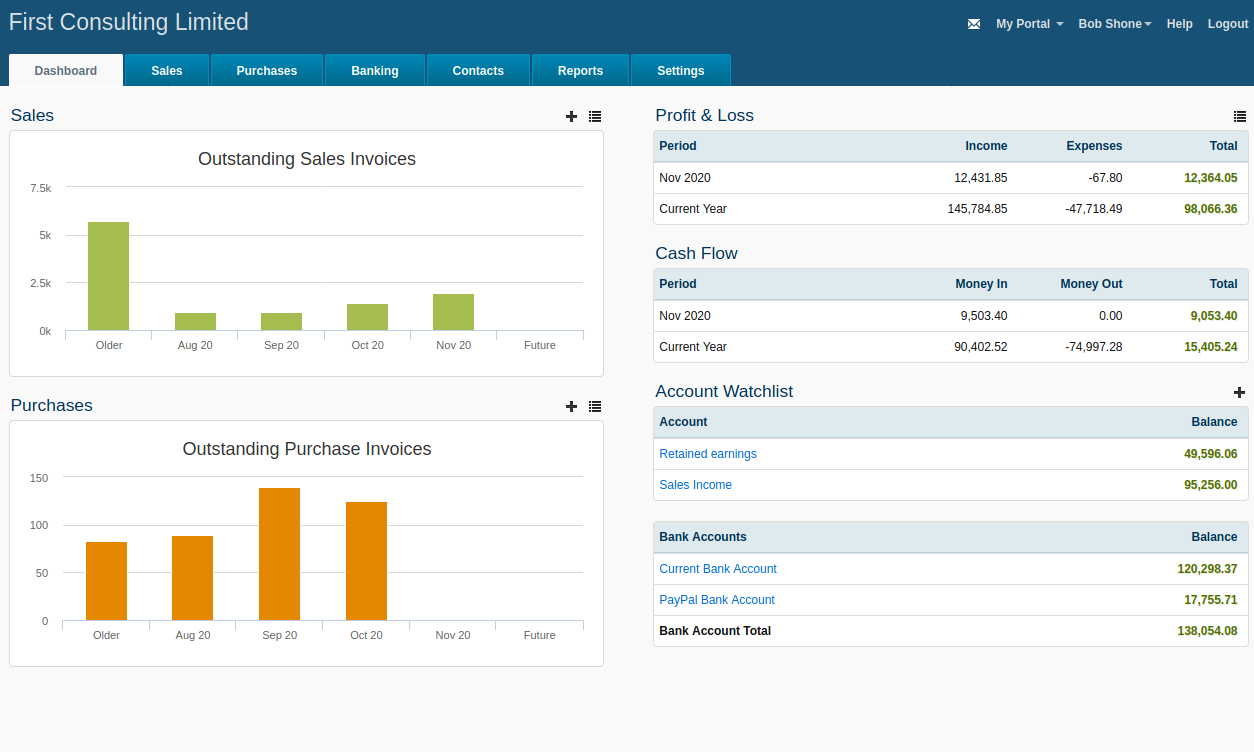

An Introduction to Accounting Dashboards

Tracy | 5 years ago

When running a business and managing accounts, it’s crucial to have a clear insight into the state of your finances. From cashflow and outstanding invoices to bank account overviews and profit and loss, being able to see at a glance how the numbers are looking can help you make business decisions, plan for the future and ensure payments aren’t overlooked.

What is Accrual Accounting?

Tracy | 5 years ago

Accrual and cash accounting are the two primary tax accounting methods. Using the accrual accounting method, revenue or expenses are recorded when a transaction occurs rather than when payment is received or made. This means income is recognised as soon as an invoice is raised, and an expense is recognised as soon as a bill comes in, even if payment won’t be made until a later date.

How to Find a Business VAT Number

Tracy | 5 years ago

Business VAT numbers are incredibly important pieces of information. Once a company is registered for VAT, it will be provided with a unique VAT number that other businesses need in order to reclaim the VAT that they have paid. Without this, a claim could be rejected, potentially resulting in a hefty bill or a time-consuming task of rectifying the situation.

Companies House Reforms Announced

Tracy | 5 years ago

After almost 18 months of debate and consultation, reforms intended to reduce fraud and give businesses greater confidence in transactions have been announced by Companies House, the UK’s registrar of companies.

How to Manage Overdue Invoices

Alison | 5 years ago

Keeping on top of cash flow and ensuring invoices are paid in a timely manner is essential if a business is going to survive and thrive. However, there will be times when, for various reasons, invoices go unpaid for longer periods than expected. This has been a particular issue for many businesses in the past few months as companies attempt to manage the challenges associated with coronavirus.

An Introduction to Invoices

Tracy | 5 years ago

Having a quick, efficient invoicing method is crucial for tracking transactions, maintaining cash flow and even reducing customer billing queries. Manually creating invoices, however, can be time consuming and can increase the likelihood of errors if data is being inputted by hand. This makes invoicing functions within accounting software a great option that can both save time and improve your company image.

Bank Feeds for your Online Accounting Software

Tracy | 5 years ago

We've revamped bank feeds in your online accounting software to give you more up-to-date information.

Top Five Cost Effective Marketing Ideas for Small Businesses

Alison | 5 years ago

It can be difficult to make yourself heard among the many companies vying for customers’ attention, particularly for small businesses. The good news, however, is that there are an array of marketing tools and ideas that can truly make a difference to your business, without breaking the bank.

Staff and Client Entertainment Expenses: What Can You Claim?

Tracy | 5 years ago

Entertaining, whether staff or clients, has been shown to bring multiple benefits. It’s important, however, to know what qualifies as an entertainment expense and what you can claim tax relief and VAT on to ensure budgets are maintained and there are no reporting inconsistencies.

Proposed Online Sales Tax - What it Could Mean For Your Business

Alison | 5 years ago

With news of redundancies now a common occurrence in the retail world, UK Chancellor Rishi Sunak announced last month that he’s consulting on a possible online sales tax in an attempt to try to protect brick and mortar retailers. Considerations include a levy of about 2% on all goods bought online and a tax on consumer deliveries.

Put Effective Credit Control Systems in Your Business

Tracy | 5 years ago

Good credit management is essential for any business. In this article we'll explore what you can do to keep your customers happy, while also ensuring that you get paid.

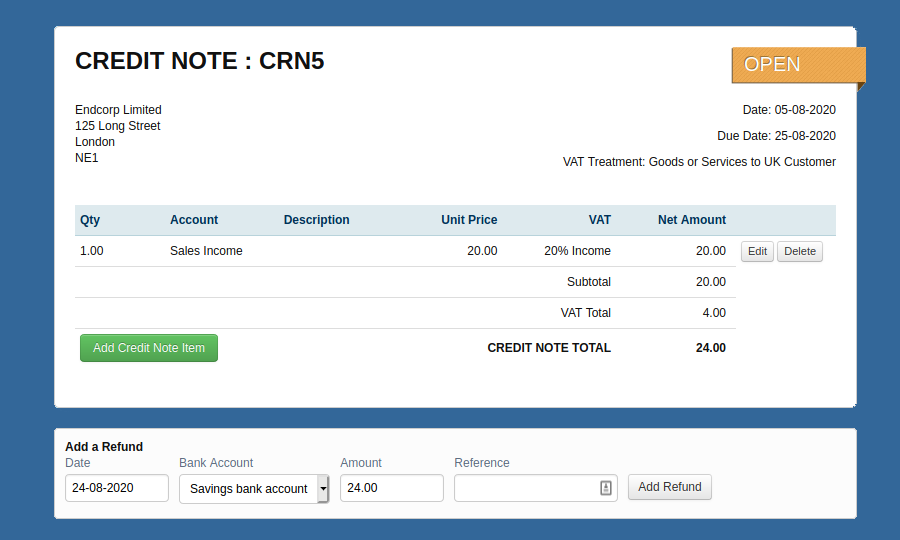

How to Generate a Credit Note in your Accounting Software

Tracy | 5 years ago

A credit note is essentially a way of correcting an invoice amount. Businesses must know how to record and deal with credit notes correctly to ensure that their accounting records are accurate.

Find out how to issue and allocate a credit in AccountsPortal.

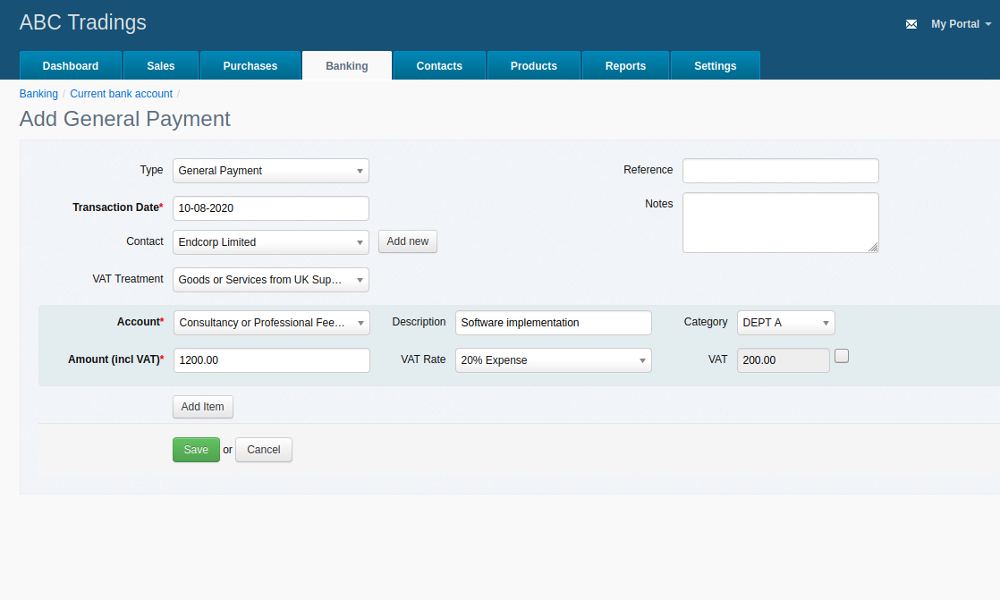

What is a General Payment?

Tracy | 5 years ago

Expenses are a core part of any business. Some businesses might have a very high level of costs – be that due to the cost of inventory, staff costs, or high overheads. Other businesses might be more fortunate and have a fairly low level of expenses.

There are a number of ways you can enter your expenses in your online accounting software, like AccountsPortal. This article looks at general payments in particular.

Making Tax Digital - What The New Rules Mean For You

Tracy | 5 years ago

Earlier this year it was announced that Making Tax Digital will be extended to include VAT-registered businesses with a taxable turnover below £85,000 from April 2022. From April 2023, most smaller businesses and landlords will also be included.

How to Keep Your Small Business Site Secure

Alison | 5 years ago

Website security is easy to overlook, particularly if your business is on the smaller side. You might be thinking that a hacker wouldn’t even consider targeting your company, or that it wouldn’t be worth their while. Sadly, too many businesses fall into this trap - and hackers are taking advantage.

Take a look at the following tips to learn how to keep your small business site secure.

Hospitality VAT Rate Cut - How To Manage The New 5% VAT Rate In AccountsPortal

Alison | 5 years ago

With effect from Wednesday 16th July, and for a period of 6 months, the VAT rate for the hospitality industry (including food, accommodation and attractions) will be reduced to 5%.

The good news is that AccountsPortal handles this out of the box!

Conversion Balances in Accounting Software

Tracy | 5 years ago

In this article we'll explore some basic concepts around Conversion Dates and Conversion Balances. These are critical when converting from another accounting system to AccountsPortal

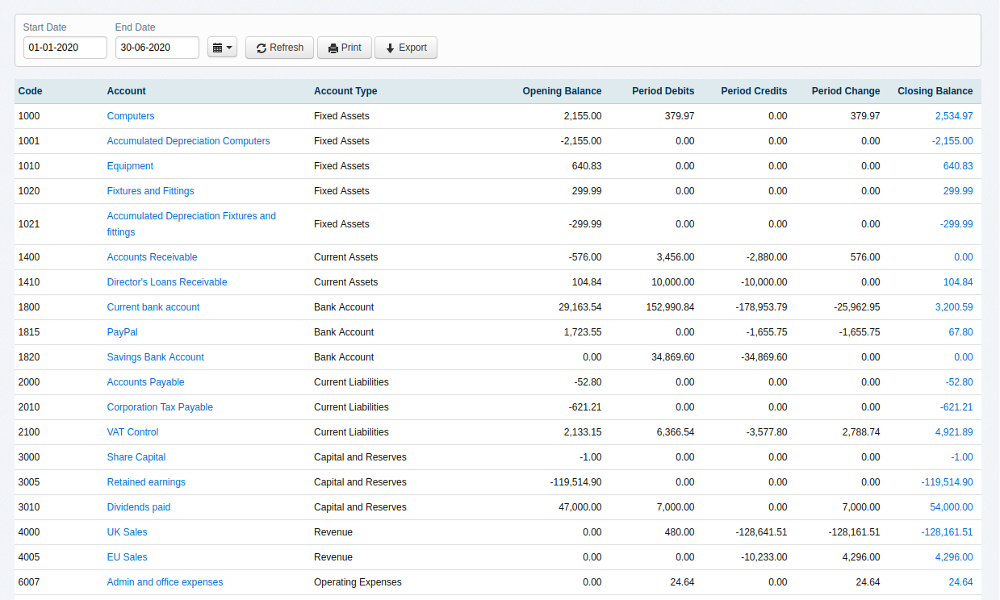

An Overview of the Period Balance Report

Tracy | 5 years ago

The period balance report is a great way to quickly see the change in debits and credits across each of your accounts over a period of time.

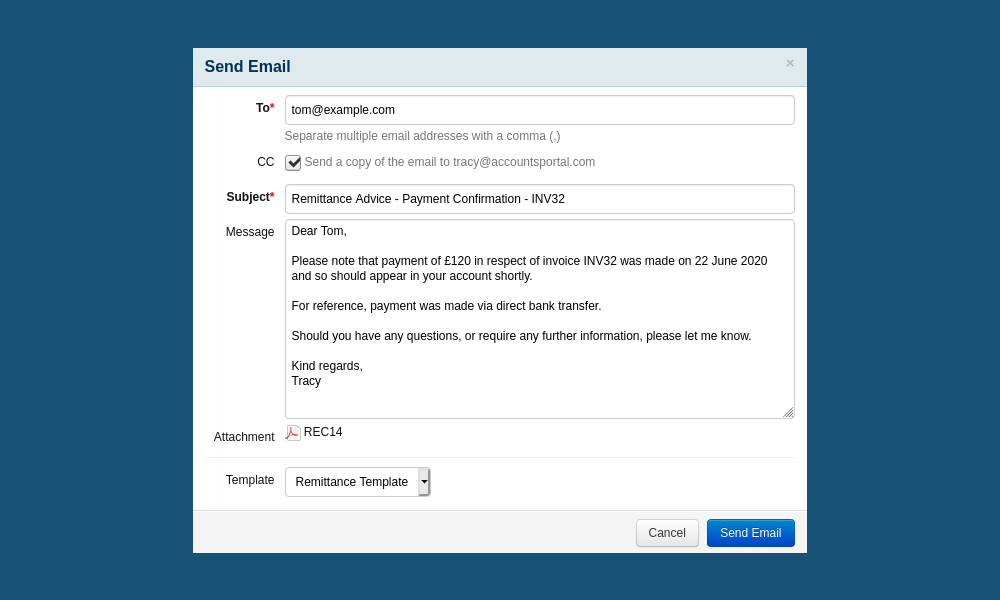

Generate a Remittance Advice in your Accounting Software

Tracy | 5 years ago

A remittance advice is a letter sent to a contact (typically a supplier) to let them know that their invoice has been paid.

Find our why this is a good idea, and how to email or print your remittances in AccountsPortal.

Getting Paid Faster Through Online Invoicing

AccountsPortal Tracy | 5 years ago

It shouldn’t be surprising to hear that having effective credit control measures in place in your business is essential for its short- and long-term success. After all, it doesn’t matter if your business has low or high margins – ultimately, if no-one pays you for the products or services you provide, you’ll find yourself out of cash and out of business.

Thankfully, there are a few ways a business can adopt good credit control practices, which includes making the most out of online accounting software.

How to Process a VAT Only Invoice

Tracy | 5 years ago

VAT Only invoices may be required if your registration is delayed and you need to charge a customer VAT in relation to an invoice that has already been sent to them excluding VAT.

Read on for how to process VAT Only invoices in your online accounting system.

Flat Rate VAT - Accounting Implications

Jon | 5 years ago

In this article well examine the Flat Rate Scheme for VAT in the UK, how it works, and the accounting implications.

How to Register for VAT

Gidon | 5 years ago

This article explains when you must register for VAT, how to register for VAT online, and what happens once you have registered.

Government Grants For Small Businesses

Gidon | 5 years ago

In the early days of your business, raising money to get your venture off the ground is one of the biggest sources of stress. Thankfully there are government initiatives that can give you support in the beginning stages. These include government loans, grants, access to enterprise and other finance schemes.

In this post, we look at how you can access these sources of funding.

Setting Small Business goals

Tracy | 5 years ago

Every small business owner needs goals to keep focused, motivated to do more and maintain success in their business.

This post includes tips on how to get started with goal setting for your small business and help you put your plan into action.

Social Media For Small Businesses

Tracy | 5 years ago

It can be overwhelming knowing where to start with social media. We've put together some advice on how to manage social media in your small business.

How to get started with AccountsPortal in 6 steps

Alison | 5 years ago

Getting started with AccountsPortal is quick and easy. It takes less than 5 minutes to set up and you’ll be managing your accounts, sending invoices and managing your tax in no time.

Budget 2020 - A Tax Summary

Tracy | 5 years ago

On March 11 2020, the Chancellor Rishi Sunak delivered Budget 2020, which will go down in history as the coronavirus budget.

This article highlights some of the key tax measures announced at Budget 2020, both related to COVID-19 and tax more widely.

Survey Results Raise Question Marks over MTD for VAT

Tracy | 5 years ago

In January 2020, the results of a survey carried out by the Chartered Institute of Taxation (CIOT) and the Association of Taxation Technicians (ATT) were published, which have cast doubt on how effective Making Tax Digital for VAT has been to date.

HMRC Releases List of Bizarre Taxpayer Excuses

Tracy | 5 years ago

Although HMRC may leniently treat taxpayers that have missed the deadline with a genuine excuse, some taxpayers have really pushed the envelope over the past few years when it comes to "reasonable" excuses.

Reported Rise in Fines from HMRC

Tracy | 6 years ago

The rate at which HMRC has issued fines in 2018/19 has increased more than tax collections.

Review into IR35 Private Sector Reforms Announced - January 2020

Tracy | 6 years ago

Although the government has announced a review of the proposed changes to IR35 legislation, many questions still loom large over the proposed reforms.

6 Ways to Improve Your Business’ Efficiency

Tracy | 6 years ago

Running a business is difficult. Whether it’s managing cash flow, optimising sales channels, or reviewing internal processes, there’s a lot for businesses to keep on top of.

With so much to juggle, sometimes it’s easy for a business’ efficiency to slip. Thankfully, it doesn’t have to be that way.