How to Prevent Issues Arising with Your Business' Cash Flow

Posted 7 years ago by Tracy

When it comes to running a business, it’s common to hear the saying “cash is king.” There’s a reason why that saying is so popular – it’s true.

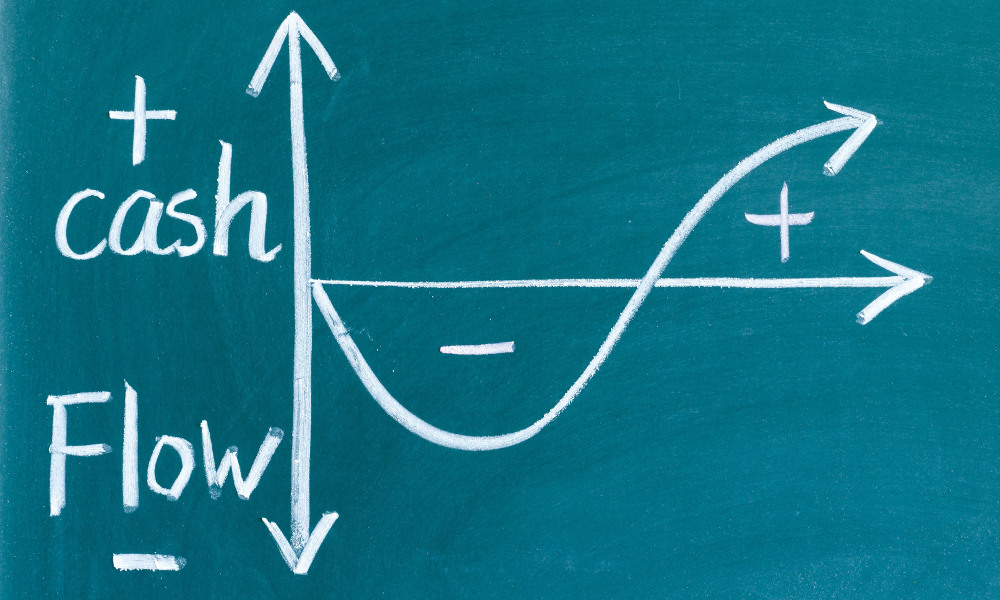

Although your business may look to be profitable from an accounting perspective, profit is not the same thing as cash. This means that unless your business actually has enough cash coming in to cover its expenses, your business will fast run into issues, whether that’s paying for stock, suppliers, or staff, which can all contribute to a business winding up.

Starting a new business is difficult and many don’t make it past the first few years’ of being in operation. One of the reasons why failure is so common amongst start-up SMEs is poor cash management.

With that in mind, let’s take a look at some of the common pitfalls that businesses face when it comes to cash flow, and how you can avoid running into these problems.

Plan ahead

One of the quickest ways for a business to encounter cash flow difficulties is by not understanding just how much cash it needs to stay operational.

This is where cash flow forecasting comes in handy. By keeping track of your projected cash inflows and outflows over a 12-month period, you should have a much more realistic idea of which months you should expect a cash surplus, and whether any months currently forecast a deficit.

When forecasting, it’s also important to keep track of your actual expenditure and income from month to month. That way, you can compare your business’ actual costs and incomings against what was projected.

This helps to keep your forecast more accurate and also gives you the opportunity to investigate any major discrepancies between actual and forecast costs before they get out of hand.

For example, if the heating and lighting costs for your premises are nearly twice what you projected, you can look into switching to another energy provider, or investigate whether inefficient heating or lighting policies might be the reason behind the higher costs.

Know when your payment windows are

A common issue experienced by SMEs is the fact that there may be a gap between when you need to pay a supplier for goods and when you actually receive cash in from customers.

For example, let’s say you have a supplier that offers 14-day payment terms, but you offer your customers a 30-day payment window. Under this example, there’s a 16-day gap between when the business has to pay out money and when it will receive money.

If a business doesn’t have sufficient cash reserves to pay the supplier, then the business will default on its payment and likely incur late-payment charges. What’s more, the business’ relationship with that supplier will likely sour.

If such gaps between cash inflows and outflows stay consistent, then that business will quickly find itself in a negative cash flow position, and may even be forced to go bust in extreme cases.

There are a few ways to address this issue. For instance, you could try and negotiate better payment terms with your suppliers, or you could try to reduce your own payment terms with customers. Equally, having a short-term credit facility, such as a credit card or a bank overdraft, can help when cash is tight.

Ultimately, the aim is to get to a position where the cash your business receives arrives before any cash is paid out, so that you eliminate, or at least reduce, any potential cash flow shortfall.

Understand the importance of good cost control

Having a healthy cash flow is relatively simple in principle – you need to ensure your business has more cash coming in each month than you have cash going out.

Although this can be difficult to master in practice, one of the best ways that you can improve the health of your business’ cash flow is to keep an eye on costs, including inventory purchases.

For example, conducting a review of your inventory at regular intervals throughout the year may help you to identify whether you have surplus stock. It may also give you a chance to review how much you’re paying for your inventory and consider whether it can be sourced for less elsewhere.

Another crucial part of good cost control is understanding the impact that seasonality can have on your business. Seasonality can affect your business in one of two ways.

On the one hand, businesses can be affected by seasonal variations in temperature - heating and electric bills may go up in winter, for example.

Understanding when and how costs are likely to change over the course of a year can make it much easier to anticipate your business’ outgoings, and help you to put efficient cash flow management processes in place.

Equally, your business may be affected by peaks and dips in customer interest, for example, if you run a café by the seaside.

If this is the case, then it’s worth planning ahead for those periods when you know that your product will be in high demand – whether that’s buying more inventory in advance or hiring more staff for the busy periods - while reducing stock purchases and staff numbers for quieter months.

Make sure you get paid on time

Just as it’s important for businesses to manage their costs, it’s equally vital that a business ensures it’s being paid promptly for the goods or services it sells.

Unsurprisingly, having lots of customers that pay you late, or even outright fail to pay you for your work, can wreak havoc on your business’ cash flow.

To avoid this, it’s worthwhile checking that payment terms are clearly displayed on any invoice you issue to a customer, while also having some form of credit control process in place to follow up on any outstanding debts. Manage growth While the goal of many SMEs is to grow, funnily enough some businesses can fall victim to their own success.

For example, if you are approached by a new client who offers you a large contract, your business may have to cover high initial costs in order to pay for the project, such as additional staff and work hours. However, you won’t get paid for the contract until the work is completed.

In this situation, your business’ cash reserves may end up completely depleted before you’ve had a chance to collect payment from the new client.

If you are looking to grow your business, it’s advisable to check whether there are sufficient cash reserves available to cover the costs of such growth. Alternatively, try to find an additional line of credit if cash might be tight – perhaps through an overdraft or a short-term loan from the bank.

Conclusion

One of the cornerstones of any business’ success is good cash flow. A business with good cash flow management is much more likely to succeed in the long term than a business that does not keep track of its cash inflows and outflows.

If you’re unsure about how your business could best improve its cash flow position, don’t hesitate to speak to your local accountant for advice. Additionally, try to think about potential ways to monitor your business’ cash flow throughout the year.

AccountsPortal lets you see how your business is performing in real-time, whether that’s through tracking which invoices remain outstanding, or showing you how your cash flow looks on a monthly or yearly basis.

Further Reading

The Benefits of Outsourcing Some Accounting Tasks

2024 Spring Budget: What does it mean for small businesses?

A Guide to Sick Pay for the Self-employed or Company Directors