Hospitality VAT rate set to rise to 12.5%: How to manage the change in AccountsPortal

Posted 4 years ago by Alison

Note that the Hospitality VAT rate has now returned to it's original rate of 20%, please see our latest post on [how to manage the change within AccountsPortal](

https://www.accountsportal.com/blog/how-to-manage-the-final-hospitality-vat-rate-increase-in-accountsportal)

From 1 October 2021, the VAT rate for businesses in the tourism and hospitality sector will increase to 12.5% as the sector transitions from the reduced rate of 5%.

Fortunately, managing this change in AccountsPortal is quick and easy. All UK-based companies are created with the required 12.5% VAT rates, which you can start using immediately.

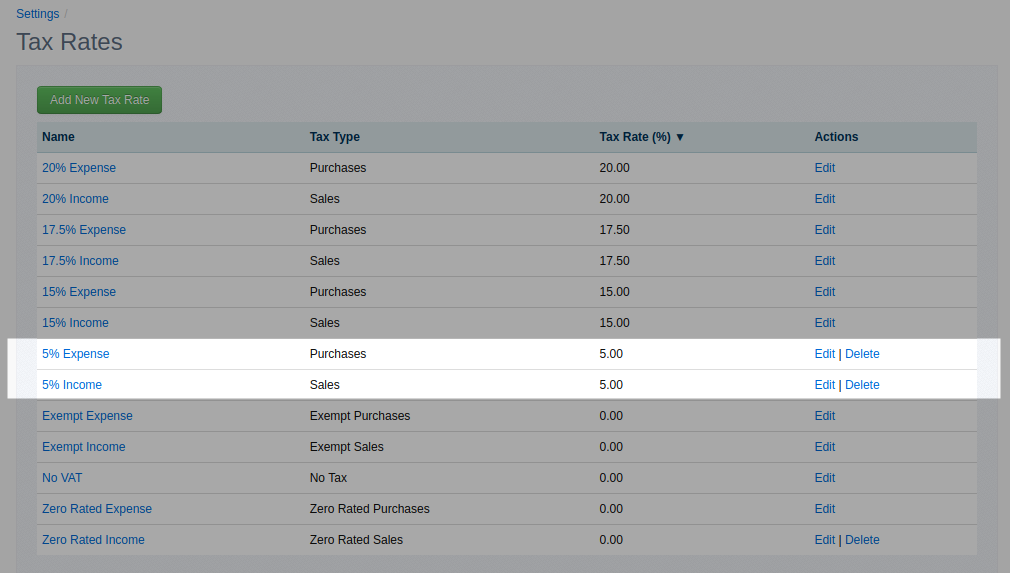

To check that you're ready, navigate to Settings, then click the Tax Rates link - you should see 12.5% Income rate (with a Tax Type of Sales) and a 12.5% Expense Rate with a Tax Type of (Purchases) listed in the Tax Rates table.

How to add new VAT rates

If either of the new rates are missing, you can add them manually in just a couple of clicks. In the Tax Rates section, simply click Add New Tax Rate, specify the name and 12.5% rate and whether it's a sales or purchase tax. Save the changes, and you're done.

Remember, you only need to add these rates if they don't already exist.

If you need any further assistance, please get in touch with us via our support pages.

Further Reading

Tips for Tracking Business Expenses