What is a General Payment?

Posted 5 years ago by Tracy

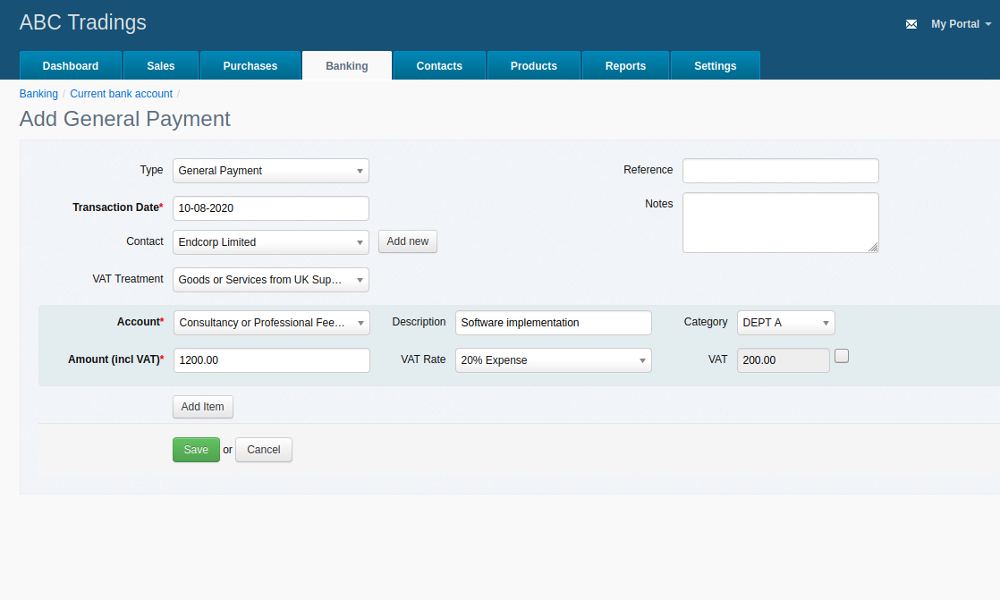

How to Record a General Payment in AccountsPortal

Expenses are a core part of any business. Some businesses might have a very high level of costs – be that due to the cost of inventory, staff costs, or high overheads. Other businesses might be more fortunate and have a fairly low level of expenses.

Whatever category you find yourself in, you can’t get away from the fact that expenses need to be accounted for and reported in your accounts.

Thankfully, there are a number of ways you can enter your expenses in online accounting software, like AccountsPortal. This article looks at general payments in particular.

What is a general payment?

There are different ways you can record a payment in online accounting software depending on the type of payment you’ve made.

Businesses should record a general payment in respect of spending where they want to record a miscellaneous purchase, a cash purchase, or when paying for a purchase and you haven’t received an invoice from the supplier.

When shouldn’t I use a general payment?

There are other ways to record an expense in AccountsPortal:

- If you’re paying a supplier’s invoice, you can enter a Supplier Invoice Payment

- If you’re refunding a customer for a product or service you provided, you can use the Customer Refund function

- If the expense is related to an overpayment to a supplier (e.g. you accidentally overpay a supplier invoice, or make an advance payment or deposit to a supplier) there is the Overpayment to Supplier function

It’s worth noting that a General Payment does not save the payment value to any Accounts Payable accounts. This is why, if you need to record an invoice payment or refund, you should use the relevant Spend Money transaction outlined above, otherwise your Accounts Payable account may not reflect the correct figures.

How to record a general payment

Navigate to the relevant bank account out of which the purchase was made, and then click on the Spend Money button, recording the payment as a General Payment.

It’s as simple as that!

Why is recording expenses correctly important?

As noted above, classifying your expenses correctly is essential to make sure that your balance sheet correctly reflects amounts owing in your Accounts Payable balance.

One way to make sure that you are recording expenses correctly is to record them in a timely manner. How often you record your expenses will depend on a number of factors, including whether you balance the books yourself, or if you use an accountant or bookkeeper.

However, as a general rule, it’s a good idea to record your income and expenses in accounting software at least monthly, although ideally daily or weekly recording would be better (particularly if you have a large volume of transactions to record).

This should also make it easier to identify which expenses should be recorded as general payments, and which should be listed as Spend Money or similar transactions.

Keeping your financials up to date also ensures that you can check in on how your business is performing in real time, thanks to the help of AccountsPortal’s real time reporting function.

See how easy reporting expenses can be in AccountsPortal, with a 30-day free trial.

Further Reading

How to Register as a Sole Trader

How to Leverage Technology and Automation to Support Your Firms Growth