How to Generate a Credit Note in your Accounting Software

Posted 5 years ago by Tracy

A credit note is essentially a way of correcting an invoice amount. As a result, it’s unlikely that you’ll have to input credit notes as often as other transactions into your accounting software.

Nevertheless, businesses must know how to record and deal with credit notes correctly to ensure that their accounting records are up to date.

Credit Note: Definition

As stated above, a credit note is a way of reducing the amount of an invoice. There are a few different reasons why you might want, or need, to issue a credit note. Some of the most common examples are listed below.

Example 1 - The amount included in your invoice to a customer was accidentally too high, and you need to reduce the amount

Example 2 - You need to give your customer a refund, whether in full or for a partially agreed sum

Whether you need to issue a credit note as a result of an honest mistake, or following a request from a customer, the end result is the same: namely, you’ll need to create or allocate a credit note in online accounting software.

Are there different credit note formats?

Generally, there are two scenarios when you might encounter a credit note.

The first, as shown in the examples above, is where you issue a credit note to effectively reduce the invoice amount that a customer owes.

The second is where a credit note relates to a payment to a supplier, with that note reducing the amount you owe to the supplier.

How do I generate a credit note on AccountsPortal?

The first step is to decide whether you need to allocate a sales credit note (where you’re reducing the amount of an invoice you’ve issued) or a purchase credit note (where you’re reducing the amount you owe to a supplier).

Once you know the appropriate type of credit note, there are two ways to allocate the credit note.

Allocate from within the Credit Note

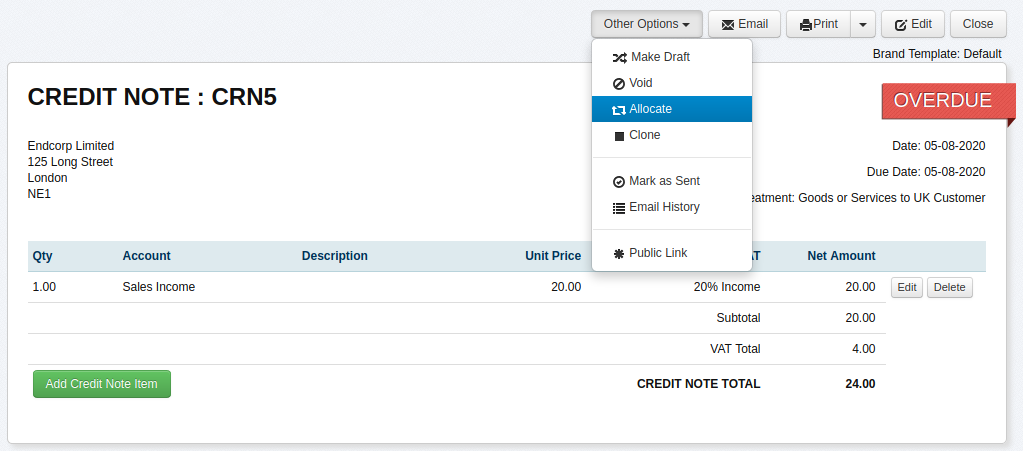

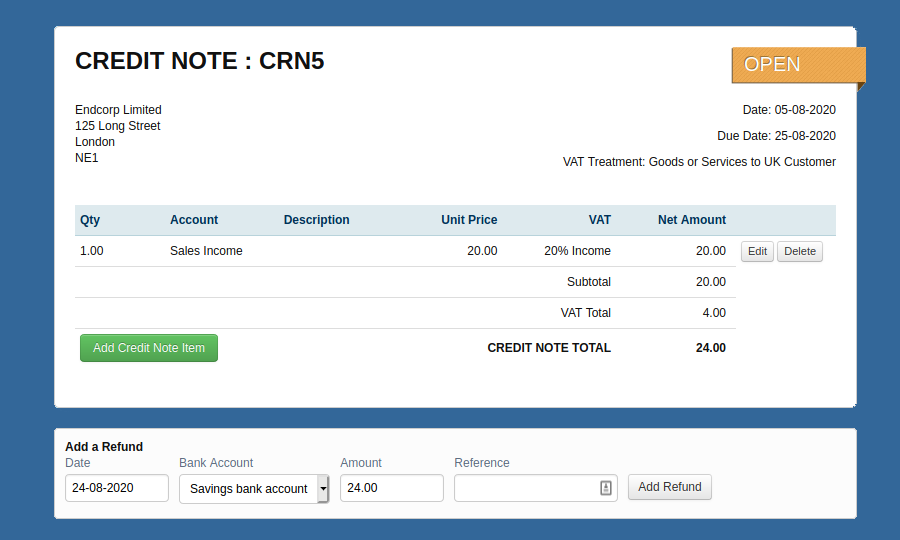

Select the appropriate Sales Credit Note or Purchase Credit Note, use the ‘Other Options’ drop-down, and select ‘Allocate’. There are a few details that need to be entered to record the credit note, including the transaction date (being the date that the allocation takes place), the invoice date and invoice amount.

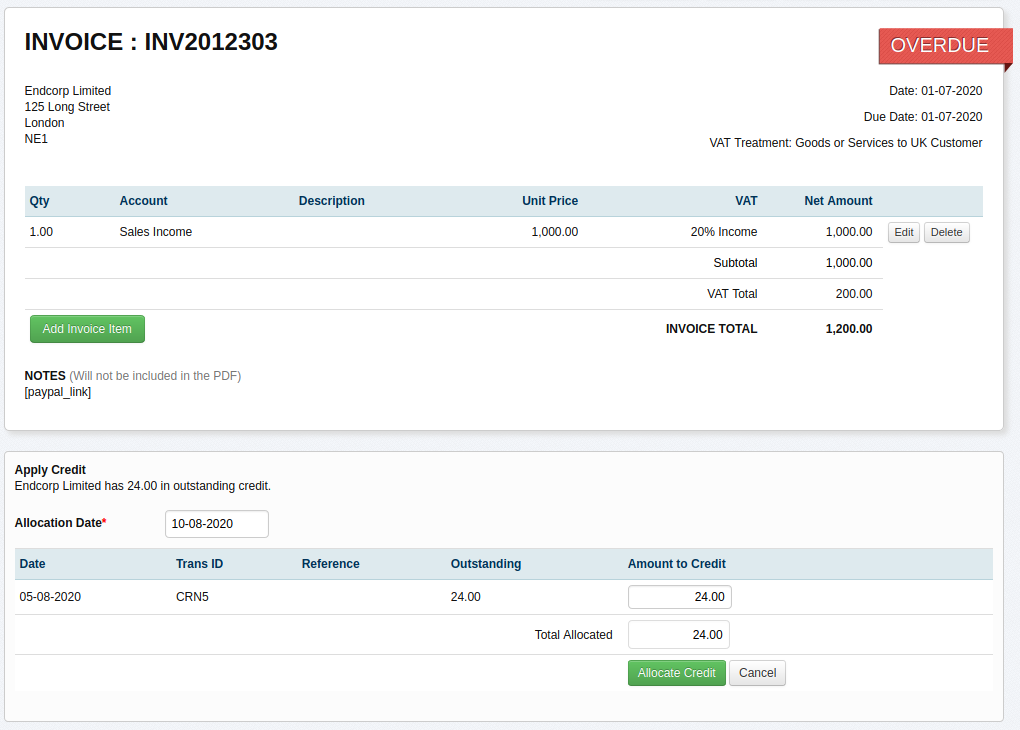

Once that information is entered, you need to decide how much of a credit note to allocate against an invoice. You can either allocate the credit note in full or in part against an invoice as needed.

Allocate from within the Invoice View

Another way to allocate a credit note is to go directly to the relevant sales or purchase invoice. If the contact has an outstanding credit note or overpayment available that you can offset against the current invoice, you can click ‘Credit this invoice’ and input the relevant information.

Further Reading

How to Register as a Sole Trader

How to Leverage Technology and Automation to Support Your Firms Growth