How to Register for Making Tax Digital in AccountsPortal

Posted 6 years ago by Alison

Making Tax Digital (MTD) is changing the way UK businesses, accountants and bookkeepers do their taxes. If you don't know what MTD is, or if you’re a new business who meets the threshold, here is a quick overview.

MTD for VAT is legislation that requires all VAT registered businesses with a taxable turnover above the £85k threshold to keep digital records and submit their VAT Returns using MTD compatible software. Companies affected by MTD for VAT will no longer be able to use HMRC Online Services.

These regulations were brought in to simplify the way that VAT returns are done, meaning no more scramble at the end of each VAT reporting period to complete your return.

If you want to learn more about Making Tax Digital, here's a deep dive into the specifics: Making Tax Digital - What Your Small Business Needs to Know.

AccountsPortal is a registered software provider with HMRC, so by using AccountsPortal you will comply with MTD regulations.

How to use AccountsPortal's Making Tax Digital features

Step 1: Register with AccountsPortal

If you are not already an AccountsPortal user, you will need to register with us at https://go.accountsportal.com.

Step 2: Government Gateway

Register for a Government Gateway account (if you do not already have one) at https://www.gov.uk/log-in-register-hmrc-online-services/register.

Step 3: Register for MTD

Once you have signed up for your Government Gateway account, you will need to register for MTD at https://www.tax.service.gov.uk/vat-through-software/sign-up/have-software.

Step 4: Receive MTD confirmation

You will need to wait to receive an email response from HMRC to confirm that your MTD account has been approved. This can take a few days.

Step 5: Link AccountsPortal to MTD

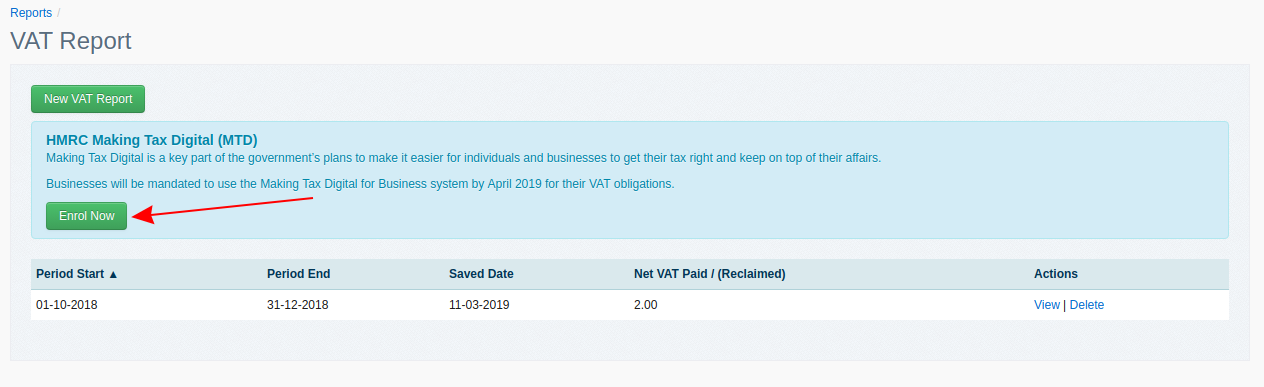

Once you have received your confirmation email from HMRC (in step 4 above), you must link AccountsPortal to your MTD account. This can be done by heading to Reports -> VAT Reports and clicking the Enrol Now button. Follow the instructions - you will be redirected to HMRC's website to confirm the integration, and then back to AccountsPortal's website.

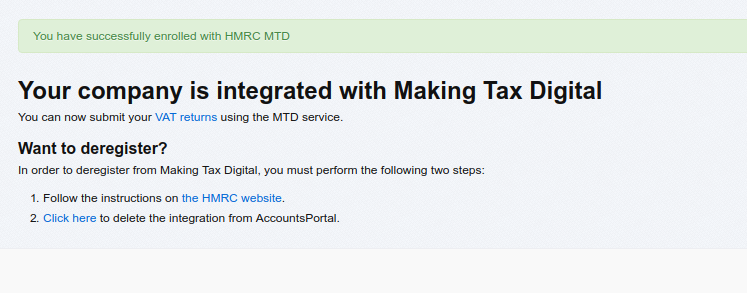

Once you have successfully integrated with HMRC, you will receive a confirmation message in AccountsPortal.

Step 6: VAT Status

Before entering any transactions in AccountsPortal make sure that you set up the appropriate VAT Status for your organisation. Carefully read the instructions at https://www.accountsportal.com/docs/tax-status/215546663.

Step 7: Transactions

Records your transactions in AccountsPortal. We will automatically calculate your VAT figures for you.

Step 8: VAT Report

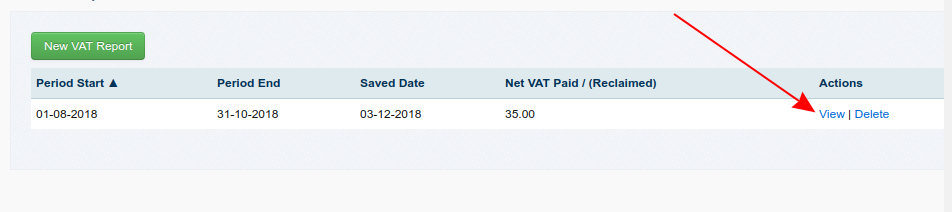

At the end of each VAT reporting period, you can generate and save your VAT return from Reports -> VAT Report. After you have saved your VAT report, click the View button.

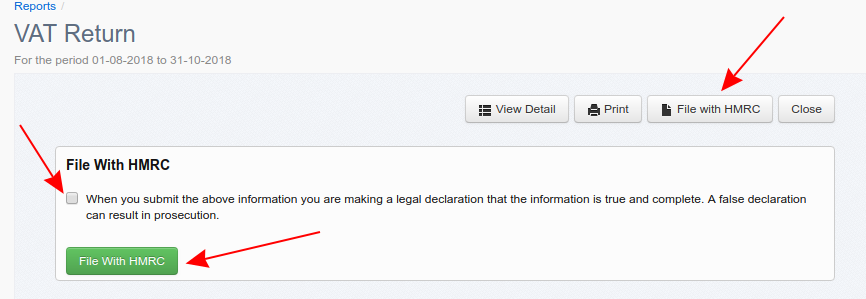

Step 9: VAT Report Submission

Once opened your VAT report, you can check that the records are correct. Once you are ready to submit the data, click the File with HMRC button. Your report will be sent electronically to HMRC.

Step 10: Success!

Your VAT return has now been sent to HMRC. Congratulations on making your first MTD submission!

If you have any questions about Making Tax Digital or VAT reports in general, please feel free to contact us.

Further Reading

Making Tax Digital for Income Tax

Making Tax Digital: New rules come into force on 1 April 2022