AccountsPortal Blog

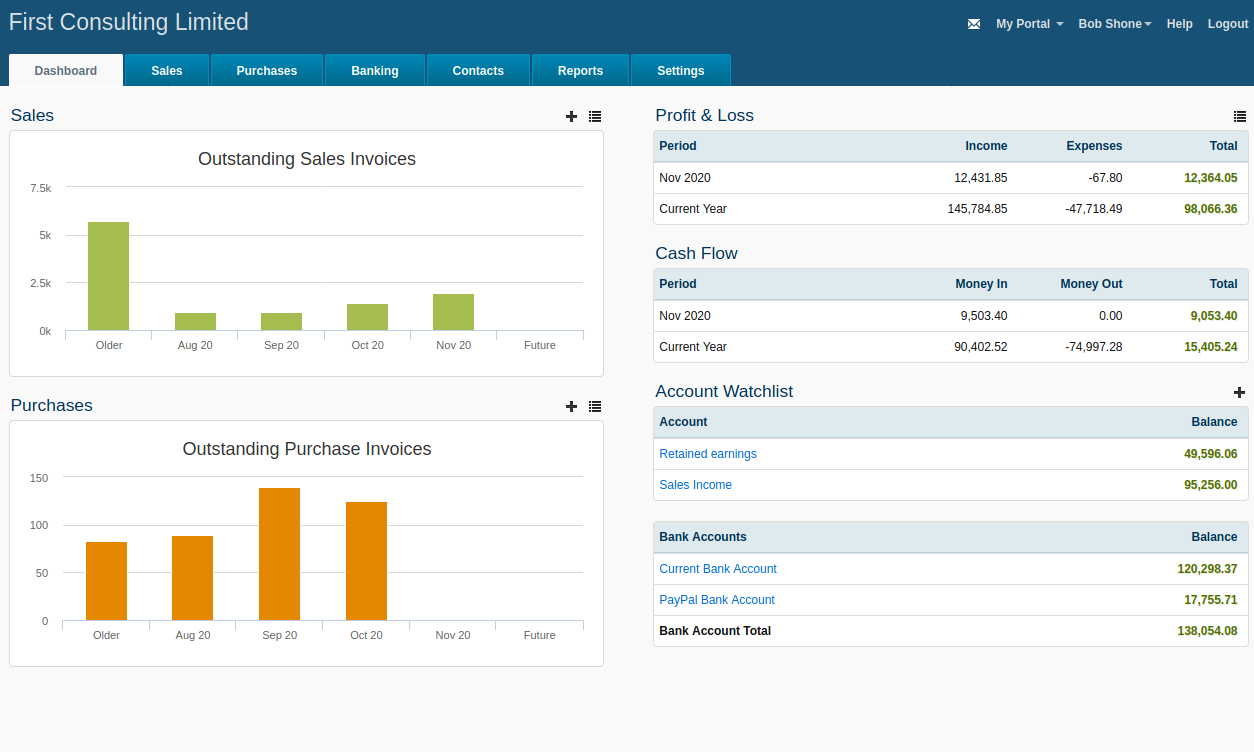

An Introduction to Accounting Dashboards

Tracy | 5 years ago

When running a business and managing accounts, it’s crucial to have a clear insight into the state of your finances. From cashflow and outstanding invoices to bank account overviews and profit and loss, being able to see at a glance how the numbers are looking can help you make business decisions, plan for the future and ensure payments aren’t overlooked.